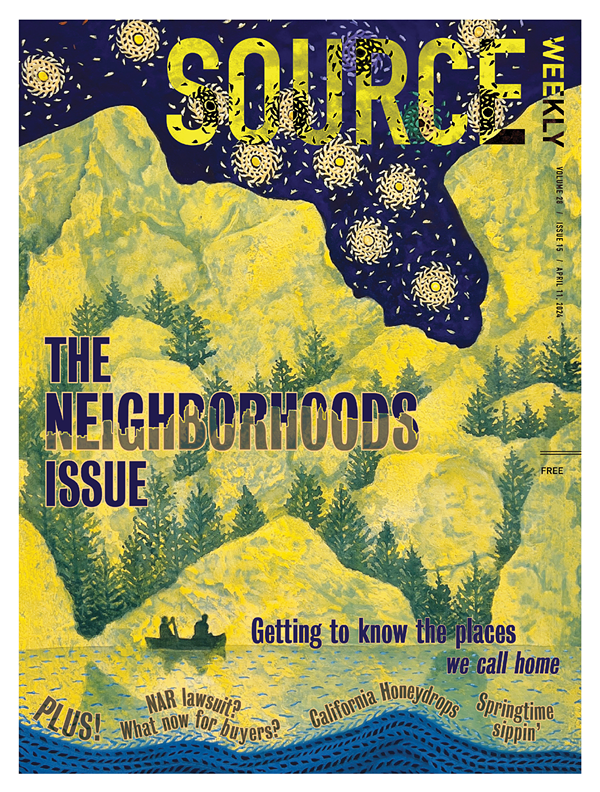

Summer is in full swing in the high desert, with high temperatures and an even hotter housing market as the July real estate numbers set records. According to the latest Beacon Report, in Bend the residential single family home median sale price jumped to a new high of $529,000, with a total of 318 homes sold. This is a substantial increase, considering the median home price has been hovering around $460,000 for the previous five months and the total number of home sales averaging around 169 during that same time period.

Some are still cautious about a major home purchase and those who are wanting to purchase a home in Central Oregon are wondering what will transpire with home prices in the future. In short, the signs are pointing to a stable increase in home sales prices for some time to come, based on the steady influx of out-of-town buyers, record-low mortgage interest rates and the demographics of millennial homebuyers with strong buying power.

Central Oregon is conceived to have its own micro-economic real-estate climate, but looking at what's happening on a national level the entire U.S. housing market is feeling the heat, as well. The national median home price is now reaching over $300,000 for the first time ever and has hit a new record median home price of $304,000, according to the National Association of Realtors.

The Mortgage Bankers Association reports that the number of purchase applications received continues to be on an upward trend, with year-over-year growth for the last four weeks, giving indication of forward-looking demand at least 30 to 90 days from now.

The answer to why the median sales price spiked so drastically in July is clear in the data. Some 120 homes, or 37 percent, of the Bend homes sold in July were over $600,000—a significant increase from previous months. Looking at the homes currently for sale, 62% are priced between $600,000 and $2,000,000, leaving only around 31% under $500,000. The driving force behind the rising prices is the result of low inventory that hasn't been keeping up with the steady increase of buyers. Many of these buyers are able and willing to pay more because of the increased buying power with low interest rates. Even with a small pause on number of sales during the initial Covid quarantine, the market is now busting with activity. Once again, millennials are paving the way and setting precedents while making up the largest portion of the workforce and largest share of home purchasing, accounting for 38% of all homebuyers, reports NAR.

Consistently, our experience has shown that homebuyer clients waiting on the fence for months expecting a dip in prices are paying tens of thousands more than they would have paid when they originally began the house hunt. Now is not the time to wait and see what happens, since there is no end in sight to rising prices and growing competition.