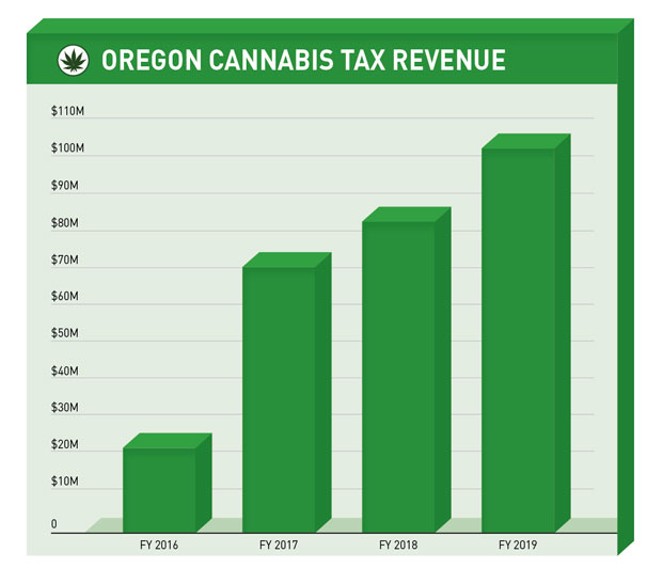

Oregon state cannabis tax revenue continues to grow, with no ceiling in sight: the State brought in $102 million during the 2019 fiscal year (July 1, 2018 – June 30, 2019), according to the Oregon Department of Revenue. This is a 24.2% increase over the $82.2 million collected in 2018.

The state taxes retail sales of cannabis products at 17% which is lower than most other states, including Washington state, where the state cannabis sales tax is 37%.

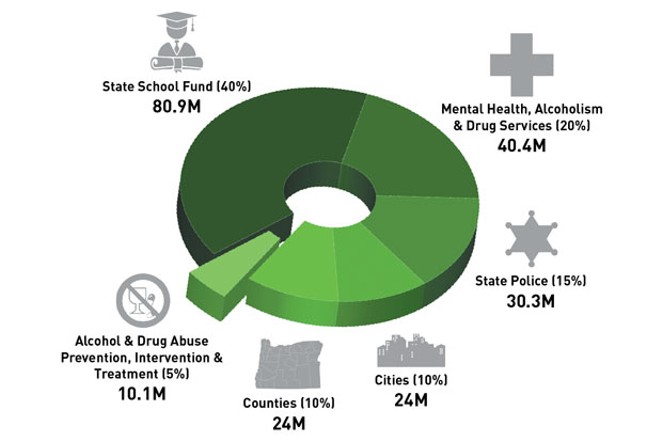

Ten percent of the money collected by the State comes back to cities. Bend received $296,173.84 in revenues for its general fund for the 2019 fiscal year, according to Melissa Bradley, the budget and financial planning manager for the City of Bend.

In November 2016, Bend voters passed a 3% additional sales tax for recreational marijuana sold within the City of Bend. The City collected $703,843.20 from this tax in 2019.

Deschutes County does not collect an additional tax on top of the State's 17%, but they do receive money back from the State for law enforcement and prevention work. During the 2019 fiscal year, the State allocated $399,519.77 to Deschutes County, according to Rich Hoover, public information officer for the Oregon Department of Revenue. To date, the County received $1,116,948 from the State, according to Whitney Hale, public information officer for Deschutes County.