A contingency in real estate is best explained as a clause in a contract where a specific condition or criteria that must be met in order to continue the forward movement to the next step in the contract. In real estate, a contingency is defined as a condition that must be met by either the buyer or seller in order for the purchase agreement and transaction to continue toward a successful close of escrow. Contingencies serve to protect both the buyer and seller, allowing the opportunity to terminate a transaction without penalty (in most cases) if a contingency condition is not met.

There are several types of contingencies in a residential purchase agreement, but five are most common.

Home Inspection: A home inspection, a comprehensive assessment of the condition of the property being purchased, is a crucial component to any real estate transaction. When a buyer is viewing a home and considering a purchase, they're looking at what's readily apparent. Buyers aren't able to conduct a detailed examination of the inner workings of the building and assess not only potential safety issues, but structural, mechanical, electrical and plumbing issues. The home inspection allows a buyer to take a deeper look at things that may not be readily apparent to a buyer during a showing and at the time of making an offer. This contingency allows the buyer the opportunity to investigate the true condition of the home and approve of the said condition before moving forward in the purchase process.

Financing Contingency: When a buyer has a pre-approval for a loan, this does not guarantee that the buyer will be able to secure financing to purchase a home. The financing contingency allows the buyer the opportunity to apply for a loan and begin the formal loan application process for a specific property. Not only does the buyer need to be approved for financing of the home, but the home must meet specific criteria in order to qualify for the loan program the buyer is using.

Appraisal Contingency: This runs hand in hand with the financing contingency. In order to secure a loan, the lender requires that the subject property market value is in line with the purchase value. Essentially, the appraisal contingency protects both the buyer and the lender from a sales price that's over what is considered fair market value.

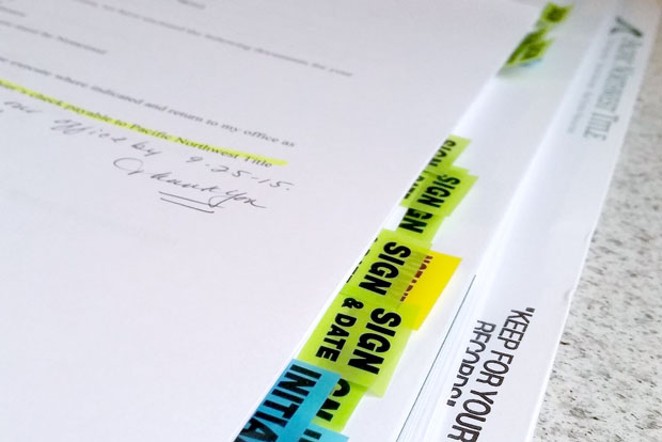

Title Contingency: The title review contingency allows the buyer the opportunity to verify that the home ownership record is clear of any liens or clouds that could potentially cause issue for the buyer. It allows the buyer to verify that the property does in fact have a clear chain of ownership. Verify and approve of any easements recorded on the property and ensure that no one else can claim ownership or right to the property.

Home Sale Contingency: This contingency is not used as commonly as it once was. It allows a buyer a specified time period to sell their current home in order to complete the transaction on the home they are offering to buy. If the buyer is unable to sell their current home, they can terminate the transaction. Additionally, a seller may also place a contingency that they must be able to find a suitable replacement property in order to complete the transaction with a buyer. These types of contingencies offer little to no assurances of the ability to close and as such have become less common in real estate purchase agreements.

Contingencies are designed as protections to allow for an informed purchase. As always, be sure to discuss any questions on the process with your local real estate professional.